A Question of Valuation: IRS to Face Off With the Heirs of Ileana Sonnabend

July 26, 2012

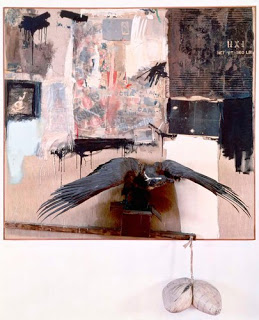

The heirs of famed art collector Ileana Sonnabend and representatives of the Internal Revenue Service will meet in Washington tax court next month to resolve whether the $29 million tax penalty will in fact be paid on Robert Rauschenberg’s “Canyon”–an artwork inherited from Sonnabend’s extensive collection.

The issue will ultimately turn on a question of valuation. Because the piece contains the stuffed remains of a bald eagle, appraisers initially told Sonnabend’s heirs that the piece’s market value was zero. Federal law makes it a crime to possess, transport, sell, or otherwise convey a bald eagle, as it is an endangered species. In 1981, Sonnabend got an informal waiver from the U.S. Fish and Wildlife Service, allowing her to keep the piece as it is considered a masterpiece of 20th century American art.

Nina Sundell and Antonio Homem, Sonnabend’s beneficiaries, have already sold $600 million in artworks from Sonnabend’s $1 billion art collection, which includes pieces by Jasper Johns and Andy Warhol, to pay the high estate taxes on her collection. However, the IRS has valued the work at $65 million and is now demanding $29 million as a special penalty rate due to their claim that Sonnabend’s heirs undervalued the work.

Disclaimer: This article is for educational purposes only and is not meant to provide legal advice. Readers should not construe or rely on any comment or statement in this article as legal advice. For legal advice, readers should seek an attorney.