How Two Artists are Challenging the SEC’s Role in Shaping the NFT Art Market

November 23, 2024

By Allie Wiley

As of the Summer of 2024, Brian L. Frye is suing the Securities and Exchange Commission along with Jonathan Mann to confront the agency’s ability to regulate non-fungible tokens head on. The SEC has taken charge of regulating art that is sold as NFTs despite being created to protect investors.[1] The issue with the SEC regulating the NFT art market is two-fold. First, the definition of securities is too broad so it can easily incorporate NFTs under the wide net.[2] As it is presently, the definition includes anything that could be understood as an investment, wrapping the art world in with it. Now that NFTs are gaining popularity within the art community, the SEC has taken aim. Secondly, the new regulations of this corner of the art market are limiting artist’s abilities to make a living. For example, Mann, sells a daily song NFT as part of his livelihood.[3] Art is critical for society so hindering the ability to make money for artists will eventually lead to less people pursuing art. NFTs are just a new medium for artists to sell their art.

How the SEC Started Regulating NFTs

NFTs are typically exchanged using cryptocurrency where you can purchase a block on a blockchain.[4] When you purchase an NFT, you own a digital asset with software specific to your NFT.[5] If you categorize NFTs as a security like the SEC has, the Securities Act of 1933 requires sellers to perform a mandatory registration process for any sale of securities.[6] Under the broad definition of “security”, any type of art could be argued as this type of investment. NFTs offer a unique way to make money in the art market that was previously untappable before 2014.[7] With the way viral content has taken over our society, selling a song a day as a NFT has helped Jonathan Mann maintain the exclusivity of his work and has allowed him, along with other artists, to continue to prosper. While there is risk involved in the NFT market, that does not mean it requires regulations from the SEC. There is risk involved in any type of “investment” you make —from your house to your car— and the SEC does not regulate those. Due to the newness of NFTs, which first emerged in 2014, there has not been a lot of time to determine if NFT art is somewhat of a fad or if it will be commonplace in art collections in the future.[8] This case will bring NFTs one step closer to becoming a permanent medium artists can rely on.

Setting SEC-NFT Precedent: The Stoner Cats Lawsuit

Stoner Cats, an animated web series starring Mila Kunis and Ashton Kutcher, sold NFTs of the animated cats to help raise money for the web series.[9] According to the SEC, Stoner Cats 2 LLC sold 10,000 NFTs for $800, each making $8 million dollars in investments for the show, while also putting on a 2.5 percent royalty for each transaction after the original was sold.[10] Crypto currency assets have to be registered to help protect investors from fraud and other risks involved in investing.[11] This resulted in a settlement between the SEC and Stoner Cats 2 LLC.[12] This settlement sparked outrage in artists Brian Frye and Jonathan Mann.

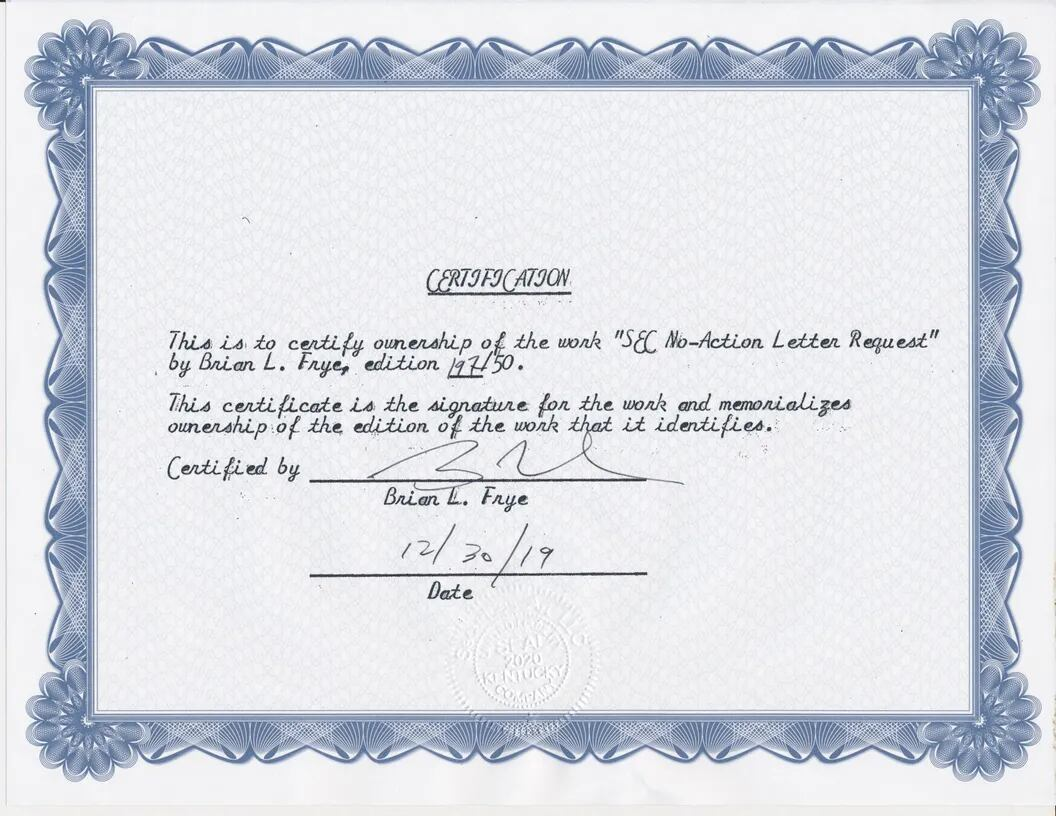

The 2024 lawsuit is not the first time that Brian Frye has tried to elicit a response from the SEC. Frye had made an NFT titled SEC No-Action Letter Request to request an SEC no-action letter to demonstrate that digital art does not violate the securities laws that they have mandated.[13] Frye and Mann’s lawsuit has been filed in Louisiana federal court.[14] A preemptive federal lawsuit like this one can happen if you have a reasonable belief that the government is going to prejudice you or your interests in some way in the future.[15] This case filing is the much needed advocacy against government agency intervention and proves the effects when an agency oversteps its administrative bounds.

The Legal Implications of Frye and Mann’s Lawsuit

So the question begs, what do Brian Frye and Jonathan Mann want to accomplish with their pending lawsuit? As it stands now, the precedent set by the Stoner Cats case is that NFTs are unregistered securities. This case is truly about redefining securities and putting the SEC back into the lane from which it strayed to protect artistic freedom as art changes with new technology. The SEC was never meant to regulate the art market and hinders a buyer’s ability to invest in an artist’s career.[16] If Congress wanted the SEC to control the art market, Congress would have included that responsibility within the scope of the SEC’s duties.[17] After all, the art market has been around for thousands of years and NFTs are just another outlet for artistic expression. Frye and Mann are calling this government agency to explain what it is doing, hoping the courts will determine the breadth of the SEC’s role in the NFT art market. With the SEC’s current stance on NFTs, Jonathan Mann has been actively breaking the law since 2022.[18] Preemptively suing the SEC seems to be the best course of action since the SEC’s targets of NFT violations have no obvious correlation.[19] When anyone could be next, it is extremely valuable for every artist to pay attention as this lawsuit unfolds.

It could be argued that the popularity in NFT regulation is from the sudden uptick in major sales of works such as Everydays: The First 5000 Days in 2021 which sold for millions of dollars.[20] The SEC, so far, has been strategic in who it sues, choosing companies that have incentives to settle due to project deadlines or other reasons.[21] This has allowed the SEC to get away with not arguing their cases in front of judges to decide what their capacity of regulating NFTs is.[22]

If the SEC wins against Frye and Mann’s lawsuit, the art market could drastically change outside of the NFT corner. It would require artists to disclose any risks associated with purchasing their work, but does not offer what disclosing risks for art means or how that differs from risk associated with stocks.[23]

Artists, legal scholars, and NFT patrons are eagerly awaiting to learn about the outcome of this lawsuit and see if the U.S. Securities and Exchange Commission or Brian L. Frye and Jonathan Mann come out ahead.

About the Author:

Allie Wiley is an undergraduate student at Indiana University Bloomington where she is preparing for law school. She has an interest in cultural heritage law and intellectual property rights.

Suggested Readings

- I’m Suing The SEC, Song Day, available at https://songaday.world/sec

- Robyn Conti, What Is An NFT? Non-Fungible Tokens Explained, Forbes, available at ihttps://www.forbes.com/advisor/investing/cryptocurrency/nft-non-fungible-token/#:~:text=NFT%20stands%20for%20non%2Dfungible,or%20exchanged%20for%20one%20another

Bibliography:

- Mission, U.S. Securities and Exchange Commission (Aug 9. 2023). ↑

- Frye, Brian L., Why I Sued the SEC, Right Click Save (Sep 11, 2024). ↑

- Hoffman, David, Suing the SEC | Jonathan Mann & Brian Frye, Bankless (Jul 30, 2024). ↑

- Conti, Robyn, What Is An NFT? Non-Fungible Tokens Explained, Forbes Advisor (May 10,2024). ↑

- Klein, Jessica, ‘Should Art Be Regulated by the SEC?’: NFT Artists’ New Lawsuit Seeks Answers, Wired (Aug 26, 2024). ↑

- Legal Information Institute, Securities Act of 1933, Cornell Law School (Oct, 2023). ↑

- Manoylov, MK, A brief history of NFTs: From CryptoPunk to Bored Apes, The Block (Oct 18, 2023). ↑

- Id. ↑

- SEC Charges Creator of Stoner Cats Web Series for Unregistered Offering of NFTs, U.S. Securities and Exchange Commission (Sep 13, 2023). ↑

- Id. ↑

- Id. ↑

- Id. ↑

- Kinsella, Eileen, NFT Artists Sue SEC, Disputing Its Regulation of Digital Art Sales, Artnet (Jul 31, 2024). ↑

- Jonathan Mann and Brian L. Frye v. Securities and Exchange Commission, Eric I. Bustillo, Gary Gensler, Caroline A. Crenshaw, Jaime E. Lizárrage, Hester M. Peirce, and Mark T. Uyeda, in their official capacities, No. 2:24-cv-01881 (E.D. La. Jul 29, 2024). ↑

- Hoffman, David, Suing the SEC | Jonathan Mann & Brian Frye, Bankless (Jul 30, 2024). ↑

- Frye, Brian L., Why I Sued the SEC, Right Click Save (Sep 11, 2024). ↑

- Id. ↑

- Mann, Jonathan, I’m Suing the SEC, songaday (Aug 6,2024). ↑

- Id. ↑

- Frye, Brian L., Why I Sued the SEC, Right Click Save (Sep 11, 2024). ↑

- Id. ↑

- Hoffman, David, Suing the SEC | Jonathan Mann & Brian Frye, Bankless (Jul 30, 2024). ↑

- Kinsella, Eileen, NFT Artists Sue SEC, Disputing Its Regulation of Digital Art Sales, Artnet (Jul 31, 2024). ↑

Disclaimer: This article is for educational purposes only and is not meant to provide legal advice. Readers should not construe or rely on any comment or statement in this article as legal advice. For legal advice, readers should seek a consultation with an attorney.